Plan for a Secure Future

Maximize Your Tax Credits with Our Retirement Experts

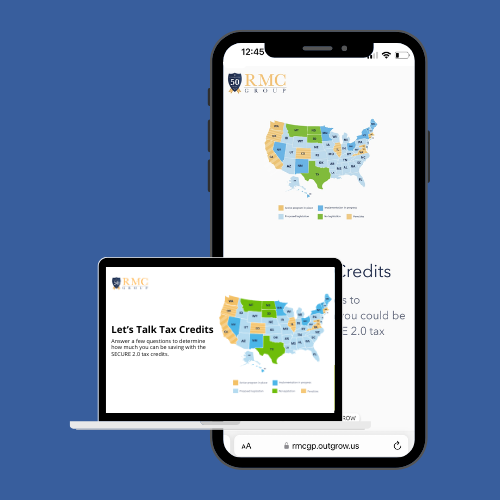

Are you a small business owner looking to enhance your retirement plans while taking advantage of the latest SECURE 2.0 tax credits? Our retirement team is here to help navigate the benefits of SECURE 2.0.

Get started today with our simple Tax Credit Calculator to see potential savings instantly ➡️

Explore Our Blogs for Detailed Information on SECURE 2.0

SECURE 2.0 Act Boosts Tax Credits for Small Employer Retirement Plans

The retirement landscape for small businesses underwent a significant transformation with the passage of the SECURE 2.0 Act. Aimed at enhancing retirement readiness and promoting the adoption of employer-sponsored plans, SECURE 2.0 included several provisions, one of which is a substantial increase in tax credits for small businesses venturing into retirement plan sponsorship.

Navigating the New Long-Term Part-Time Employee Regulations

In a significant development, the Department of the Treasury and the Internal Revenue Service published proposed regulations setting forth rules for the treatment of long-term part-time employees (LTPTE) in qualified retirement plans. Released on November 24, 2023, with an effective date of January 1, 2024, the regulations provide crucial guidance on eligibility, vesting, and administration for 401(k) plans.

Form 8881 - Tax Credit for Small Employer Pension Plan

Discover how your small business can benefit from two powerful tax credits introduced by the SECURE Act 2.0. This blog post breaks down the start-up credit, which helps cover the costs of establishing a retirement plan, and the employer contribution credit, which supports contributions to employee retirement accounts. Learn how these credits work, who qualifies, and how they can significantly reduce your tax bill while enhancing your employee benefits. Dive in to find out how to maximize these opportunities for your business.